Kandi Technologies reports 2024 financial results, launches first U.S.-made vehicle

Kandi Technologies Group, Inc., a manufacturer of electric off-road and utility vehicles with headquarters in China, reported its financial results for the full year 2024 while achieving a significant milestone in its U.S. expansion strategy with the launch of its first locally produced vehicle.

2024 FINANCIAL RESULTS

Kandi reported total revenue of $127.6 million in 2024, a 3.2% increase from $123.6 million in 2023. Sales of electric off-road vehicles and parts, which accounted for over 91% of total revenue, rose 8.9% year-over-year to $116.6 million. Geographically, revenue from China grew 80% year-over-year, contributing to improved sales diversification. Gross profit totaled $39.3 million, though gross margin declined from 33.5% to 30.8% due to shifts in regional and product mix.

Operating expenses increased to $108.1 million, driven by investments in retail expansion, organizational development, and a one-time, non-cash impairment loss of $24.1 million. This led to a net loss of $51 million compared to net income of $1.7 million in 2023. Despite these challenges, Kandi remains focused on strengthening its electric off-road vehicle business and advancing its strategic initiatives.

LAUNCH OF U.S. OPERATIONS

In a major development, Kandi’s manufacturing facility in Garland, Texas, has commenced operations, producing its first electric golf cart. This facility marks a key milestone in Kandi’s “Made in North America” initiative, enhancing its ability to serve the U.S. market. The Garland facility, spanning over 74,000 square feet, will support the production of Kandi’s complete lineup of electric off-road vehicles, including UTVs and recreational models.

“The launch of our Texas facility positions Kandi as a local producer of high-quality electric off-road vehicles,” says Feng Chen, CEO of Kandi Technologies. “This achievement enhances our operational flexibility, shortens delivery times, and strengthens our competitiveness in North America.”

As part of its localization strategy, Kandi has also partnered with CBAK Energy Technology to develop two lithium battery production facilities in the United States, further advancing its domestic manufacturing footprint.

Looking Ahead

Kandi plans to continue expanding its geographic reach, product offerings, and supply chain capabilities while investing in innovation to meet growing demand for electric off-road vehicles. With its enhanced infrastructure and localized production, the company is positioned for future growth in the U.S. and global markets.

Kandi Technologies continues to expand in the U.S., with a grand opening at Galaxy Golf Cars and a manufacturing plant in Garland, Texas. (Photo: Kandi Technologies/Galaxy Golf Cars/Facebook)

Transax joins Talon to provide a more connected experience for dealers

Transax, a connected commerce platform for the powersports industry, has joined Talon Powersports Solutions as a certified API partner. This collaboration will integrate the two systems, helping dealerships perform faster transactions, achieve better data accuracy, and improve real-time inventory access.

STREAMLINING DEALERSHIP OPERATIONS

The API partnership enhances dealership efficiency in several key areas, starting with seamless data flow. Through integration, customer information can now move easily between Transax and Talon’s dealer management system, eliminating manual entry and ensuring accuracy at every step of the sales journey.

Another advantage of the integration is real-time access to inventory and pricing. Dealers can instantly view and act on the most up-to-date information — pulling inventory from Talon into Transax or starting a deal in Transax and pushing it into Talon — reducing transaction times, maximizing efficiency, and closing more.

OPTIMIZING PERFORMANCE

Talon dealers utilizing Transax can elevate their experience through the Connected Commerce Platform, which enables them to display payments and financing options on every unit, driving more qualified leads and increasing finance application rates. Dealers can send quotes, automate follow-ups, and request payments via text or email, all while tracking activity through built-in CRM tools. With unlimited soft credit pulls, credit applications, and lender integration, combined with Talon‘s capabilities, dealers can streamline data flow, accelerate deal completion, and keep customers engaged.

“We’re excited to partner with Talon to deliver a more connected experience for dealers,” says Jared Dowdy, vice president of sales and strategic partnerships at Transax. “This integration helps eliminate bottlenecks in the sales process and ensures that data flows accurately and instantly across systems — ultimately improving the customer experience and speeding up deal completion.”

Transax has joined Talon Powersports Solutions as a certified API partner. (Image: Transax)

Harley focuses on financing arm, addresses tariffs and consumer trends in Q1 earnings call

Harley-Davidson offered insight into its strategic direction and business outlook during its first-quarter 2025 earnings call, emphasizing stability within its financial services division, the impact of global trade policies, and evolving consumer behavior. Harley’s Q1 retail sales were down 21% globally and 24% in North America, as the company continues to deal with headwinds from slowing consumer demand and planned lower shipments to dealers.

“Our first quarter results were ahead of our expectations in many areas, while retail sales in the U.S. were softer than anticipated. We remain focused on navigating the challenging economic and tariff environment through diligent execution of our cost productivity measures, supply chain mitigation, tight operating expense control, and reducing dealer inventory,” says Jochen Zeitz, chairman, president and CEO of Harley-Davidson. “In addition, we remain committed to driving retail sales through increased marketing initiatives as we enter the riding season.”

STRATEGIC OPTIONS UNDER REVIEW

The company reiterated that Harley-Davidson Financial Services (HDFS), its in-house financing division, remains a core component of its business. However, leadership acknowledged interest in exploring structural changes that could better reflect HDFS’s market value while continuing to support Harley’s dealers and customers.

“This is not about divestiture,” says Jonathan Root, president of commercial services and former president of HDFS. “We’re looking at ways to improve governance, transparency, and long-term value creation — without disrupting the customer experience or product continuity.”

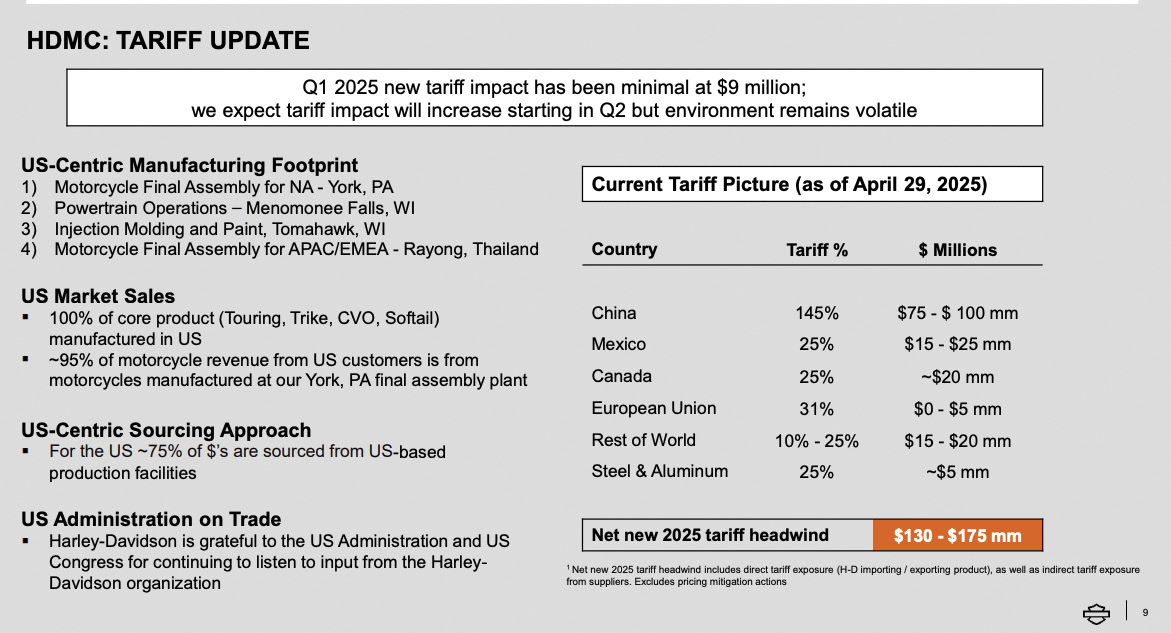

TRADE POLICY CHALLENGES

Executives also highlighted persistent global trade risks, particularly the steep 145% tariff on certain Chinese components. While Harley has aggressively reshaped its supply chain since 2018—now sourcing approximately 75% of components from the U.S.—the company warned that some cost pressure remains.

“We’ve taken significant steps to diversify our sourcing, but certain policies still pose a challenge,” says Zeitz. “We’re ahead of the curve, but we continue to monitor regulatory developments closely.”

RETAIL & CONSUMER SENTIMENT

Despite softer-than-expected industry demand in early 2025, Harley-Davidson reported sequential retail improvements in April and expressed optimism for the months ahead.

Internal surveys revealed that elevated interest rates and macroeconomic uncertainty are influencing customer behavior, with many delaying discretionary purchases like motorcycles.

“We’re seeing progress, especially in North America, but the environment remains mixed,” notes Zeitz. “Our focus is on maintaining pricing discipline, targeted promotions, and long-term brand strength.”

RETURN TO ENTRY-LEVEL

Harley-Davidson also confirmed plans to re-enter the entry-level motorcycle segment in the near future, signaling a renewed push to attract younger and first-time riders while maintaining its premium image. This move aligns with the company’s broader ambition to modernize its product lineup and expand its customer base. However, one thing is for sure: Harley is betting on the brand and its ability to attract and retain riders. Delivering them to the bottom line will be another story we will follow closely.

Harley offered insight into its strategic direction and tariff impact during its first-quarter earnings call. (Chart : Harley-Davidson)

Royal Enfield reports revenues rise 6% YoY for April

Royal Enfield recently announced that the company sold 86,559 motorcycles in April, compared to 82,043 sold in the same month last year, an increase of 6%.

The company reported sales in the Indian market reached 76,002 units in April, just a modest 1% growth from the 75,038 units sold in the same period last year. Sales outside of India, however, were up 55%, as the company exported 10,557 motorcycles in April, compared to 6,832 exported during the same month last year.

“After achieving the million-unit sales milestone in the past financial year, this year is also off to a flying start,” says the company’s CEO B Govindarajan. “As we move further into the new financial year, we are excited about what’s coming next while staying true to our core philosophy of pure motorcycling.”

In April, Royal Enfield introduced its 2025 Hunter 350 in the Indian market. With the update, the company says it took customer feedback and tried to fix all the issues that were reported with the outgoing generation, which includes a new rear suspension, revised seat foam, an LED headlamp, more ground clearance, and a slipper clutch.

Govindarajan also says the company is expanding its international footprint, introducing the Classic 350 in Nepal and “continuing to deepen our connection with our global riding community.” Royal Enfield also announced it expects the Flying Flea — the company’s first electric motorcycle — to hit the market at the end of 2025.

Royal Enfield reported a 55% YoY increase in exported units for April, but just a 1% increase in sales in the Indian market. (Photos: Royal Enfield)

The 2025 Hunter 350 will feature a revised rear suspension with progressive springs for improved ride comfort.

The Flying Flea, Royal Enfield’s first electric motorcycle, is designed to be lightweight, nimble, and durable.

Harley ponders HDFS sale, according to Bloomberg

Harley-Davidson is evaluating options for its financing unit, Harley-Davidson Financial Services (HDFS), including a sale, which could bring the company at least $1 billion.

According to Bloomberg, potential buyers could include banks, private equity firms, and private credit firms. However, no decision has been made yet, and Harley could choose to retain ownership of HDFS, which has brought in substantial revenue for the company and is a popular way for consumers to finance its premium models.

In an email to the Milwaukee Journal Sentinel, Harley-Davidson said it would not comment on market rumors or speculation. However, Bloomberg cites unnamed sources familiar with the matter in its piece. The Motor Company is said to be using an adviser to generate interest in HDFS.

Harley hasn’t made a final decision to sell the financing division, and reports state that the manufacturer is merely weighing its options and may ultimately decide to keep it. Reaction to the news has been mixed, with some saying it would be a mistake to pull that part of the business out of the company’s control, especially as the price of its bikes continue to rise.

The potential sale of HDFS comes as Harley has experienced considerable internal turmoil. It was announced on April 8 that CEO Jochen Zeitz plans to step down after five years. And shortly after, board member Jared Dourdeville, a partner of major shareholder H Partners, abruptly resigned, sending a widely circulated letter to the SEC about his discontent with the current management at the Motor Company. H Partners is also caught up in a proxy fight with Harley for control over the board and is asking for three members, including Zeitz, to step down immediately.

Bloomberg reports that Harley is considering a potential sale of its financing arm, HDFS. (Photo: Harley-Davidson)

RumbleOn reports Q1 revenue drop, narrows loss amid turnaround efforts

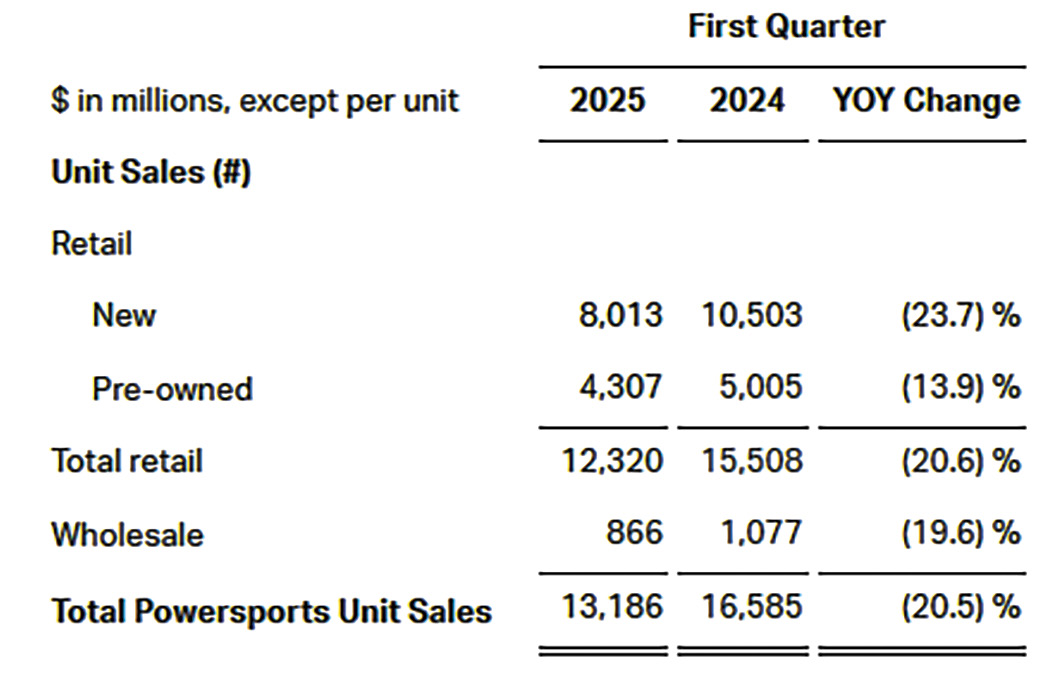

RumbleOn, the largest powersports retailer in North America, reported a 20.5% year-over-year decline in revenue for the first quarter of 2025, totaling $244.7 million. The drop was largely attributed to a significant slowdown in powersports unit sales and a steep decline in vehicle transportation activity.

Despite lower revenues, RumbleOn slightly narrowed its net loss to $9.7 million, compared to $10.3 million in the first quarter of 2024. The company also made meaningful progress on cost control, slashing its selling, general, and administrative expenses (SG&A) by $12.8 million to $61.1 million.

“CEO and Chairman Michael Quartieri, who is also serving as interim CFO, expressed optimism – “Although we experienced a year-over-year volume decline in our powersports segment, the team is making progress on our turnaround initiatives.”

KEY Q1 METRICS

Total revenue: $244.7 million (20.5%)

Gross profit: $67.2 million (18.6%)

Adjusted EBITDA: $7 million (9.1%)

Operating cash flow: Outflow of $6.9 million (compared to $17 million inflow in Q1 2024)

Total powersports unit sales: 13,186 (20.5%)

Vehicle transportation services revenue: $5.5 million (61.5%)

The powersports segment saw a 23.7% drop in new vehicle sales and a 13.9% decline in pre-owned sales. However, gross profit per unit (GPU) improved by 5.2% to $5,365, signaling better margins despite fewer sales.

Meanwhile, RumbleOn’s vehicle transportation services saw a sharp 65% plunge in vehicle transports, contributing to an $8.8 million revenue decline for the segment.

On the balance sheet side, the company repaid $38.8 million in convertible senior notes and ended the quarter with $56.2 million in total cash and $171.4 million in available liquidity. Inventory rose to $272.6 million, while total liabilities slightly decreased to $712 million.

RumbleOn CEO and Chairman Michael Quartieri, who is also serving as interim CFO, expressed optimism about the Q1 results. (Photo: RumbleOn)

Piaggio Group reports resilient margins despite market headwinds in Q1

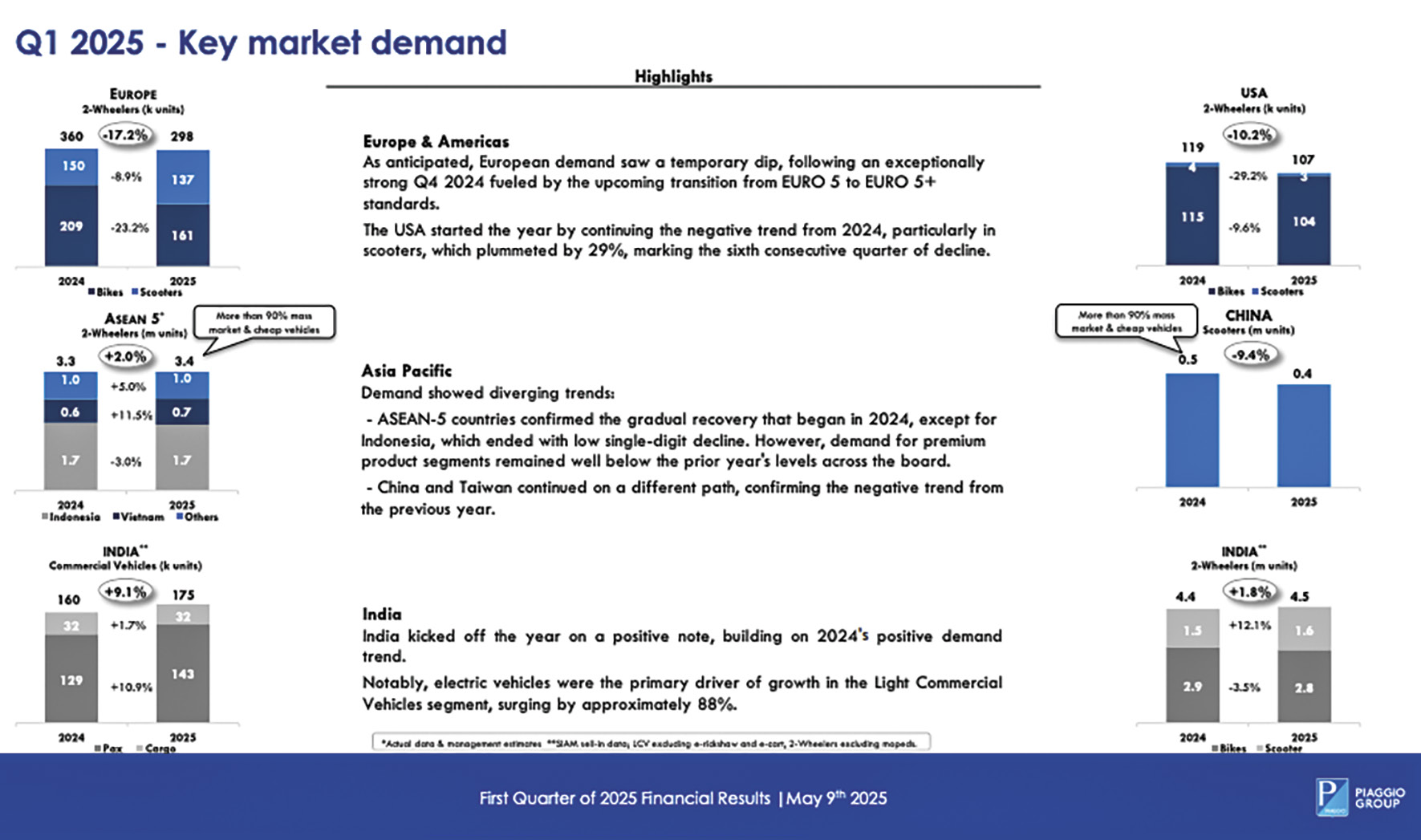

The Piaggio Group, maker of iconic powersports brands including Vespa, Aprilia, and Moto Guzzi, reported a resilient gross margin of 30.5% in the first quarter of 2025, despite a 13.4% decline in net sales amid global economic and geopolitical challenges.

Speaking on the results, CEO Michele Colaninno says, “The beginning of the year was once again marked by international markets seeking stability and ongoing macroeconomic and geopolitical complexity, which we continue to counter with a prudent management approach.”

SALES DECLINE

Piaggio reported consolidated net sales of €370.7 million ($412.9 million USD) for Q1 2025, down from €428 million ($476.8 million USD) in the same period last year. Sales contracted across all major regions: EMEA & Americas (-17.2%), Asia Pacific (-10.5%), and India (-2.3%).

Vehicle shipments fell 11.3% to 106,800 units globally, compared to 120,300 in Q1 2024. The slowdown was partially attributed to the post-registration slump in Europe following the rollout of the “EURO 5+” emissions standard, which had pulled forward purchases into Q4 2024.

“Europe remains a highly competitive market, as it is still the largest globally by value,” says Colaninno. “Our strategy has been to maintain our pricing and avoid entering into aggressive discounting wars. While we support dealers with localized promotions when appropriate, we believe it would be a mistake to devalue our brand in an already soft market. Discounting doesn’t necessarily increase volumes, so preserving margin and continuing to invest in brand equity is the smarter long-term approach.

In Asia-Pacific (APAC), Piaggio is taking a similar stance. “We’re maintaining prices and continuing to invest, because we see strong medium- to long-term potential in that region,” the CEO comments. “The market remains difficult to predict, especially with recent U.S. tariff developments. Some customers in April moved early, anticipating price hikes, but the volume impact was limited and mostly psychological. If tariffs are implemented, we will adjust our commercial policies as needed, particularly in the mid-size motorcycle segment where the U.S. remains an important market for us.”

MARGIN MANAGEMENT

Despite lower sales volumes, the company maintained a robust margin of €113.2 million (30.5% of net sales), nearly flat from 30.4% in Q1 2024. Colaninno attributes this resilience to disciplined cost controls, technology investment, and strategic pricing.

“We are not reducing prices,” Colaninno emphasizes. “Instead, we’re maintaining margins through operational efficiency and investment in brand equity.”

EBITDA dropped 17.7% to €62 million, and EBIT fell sharply by 41% to €24.4 million. Net profit stood at €8.7 million, down from €18.7 million a year earlier.

BRAND PERFORMANCE

Two-wheeler sales totaled 78,700 units, with revenues of €283.9 million, down from €331.7 million in Q1 2024. Piaggio’s scooter lineup, particularly the updated Liberty and Medley models, performed well, as did the new Aprilia RS 457 and Moto Guzzi V85 motorcycles.

The company maintained its market share in key segments, holding 15.3% of the European scooter market and 29.9% in North America.

Sales of commercial vehicles dropped slightly to 28,000 units. However, South America and India showed signs of strength, especially in the electric three-wheeler category.

R&D AND ROBOTICS

Piaggio Fast Forward (PFF), the group’s U.S.-based robotics subsidiary, continued to market its mobile following robots — Gita, Gita Mini, and the newly launched kilo. The kilo, capable of carrying 130 kg, leverages proprietary 4D radar and sensor technology, debuted in March.

PFF’s sensors also debuted on the new Moto Guzzi Stelvio, contributing to advanced rider assistance systems (ARAS) for enhanced safety.

CAPITAL INVESTMENTS

Capital expenditure rose slightly to €39.4 million (+1.2%), reflecting continued investment in manufacturing, R&D, and new product development. Due to seasonal cash flow patterns and investment activities, net financial debt increased to €592.8 million, up from €534 million at year-end 2024.

LOOKING AHEAD

Colaninno reiterated Piaggio’s long-term product-driven strategy, focused on combining innovation with operational discipline. “We will continue to carefully manage productivity while growing investments in our iconic brands, technology, and manufacturing.”

For U.S. dealers, Piaggio’s steady focus on margin protection, premium positioning, and new product launches offers a clear signal: the group is navigating headwinds by reinforcing brand value rather than sacrificing profitability.

Piaggio’s North American sales continued the downward trend from 2024, with scooter sales plummeting 29 percent.