Powersports Business • July 2025 • 3

www . PowersportsBusiness . com

Beta, an Italian motorcycle manufacturer specializing in off-road bikes, recently announced that between 2018 and 2024, its U.S. sales increased by 180%.

Beta USA sales from 2008 to 2014 saw large increases due to the addition of the Trial range of motorcycles, as well as the development and introduction of the complete range of twostroke models in 2013. (Photo: Beta USA)

NEWS

4 Suzuki Marine promotes two execs 6 Ride to Work Day hits Capitol Hill 7 Equip Expo debuts small-batch bourbon 8 Dealership merger forms St. Louis

The company says it is still seeing close to an additional 10% growth from 2024 to 2025 despite a few other companies saturating the market. In April, the Italian OEM introduced its new line of performancedriven motorcycles to the U.S.

Harley-Davidson

“I feel there are many reasons for this growth, it starts with our engineers developing the motorcycles, to our dealers that have grown their dealership with our brand, and also to the customers who continue to purchase new Beta’s and at the same time, tell their friends about us,” says Tim Pilg, president of Beta USA.

OPINION

9 Pre-owned preview 9 Industry podcasts

FINANCE

Beta USA continues to expand by adding new dealers in key markets without taking away sales from existing Beta dealers . Pilg adds that, “We want to keep a good balance of dealers in each market area where they are not fighting for sales but rather focusing on being profitable so they can provide the Beta owner with a higher level of dealer service.”

10 BRP reports Q1 results 11 My Financing simplifies listing process 12 Same store sales report 13 Fox’s first quarter earnings

Beta USA is the sole distribution arm for all Beta motorcycles in the U.S. market. Betamotor S.p.A. is the parent company based out of Florence, Italy and, like Beta USA, is a family business. Beta has been manufacturing two-wheeled products since 1905, all by the same family.

Beta continues to be the highest resale off-road motorcycle in the U.S., mostly in part due to the overall demand for the products . Beta USA says it takes pride in the service that it provides to its 200 dealers nationwide, as well as the support it provides to all Beta owners.

SOLUTIONS

14 Insurance market tightens 15 Terminating your dealer agreement 16 Ep. 1: Saving a dealership

PWC/ MARINE

17 Yamaha revives ‘Yellow Hat’

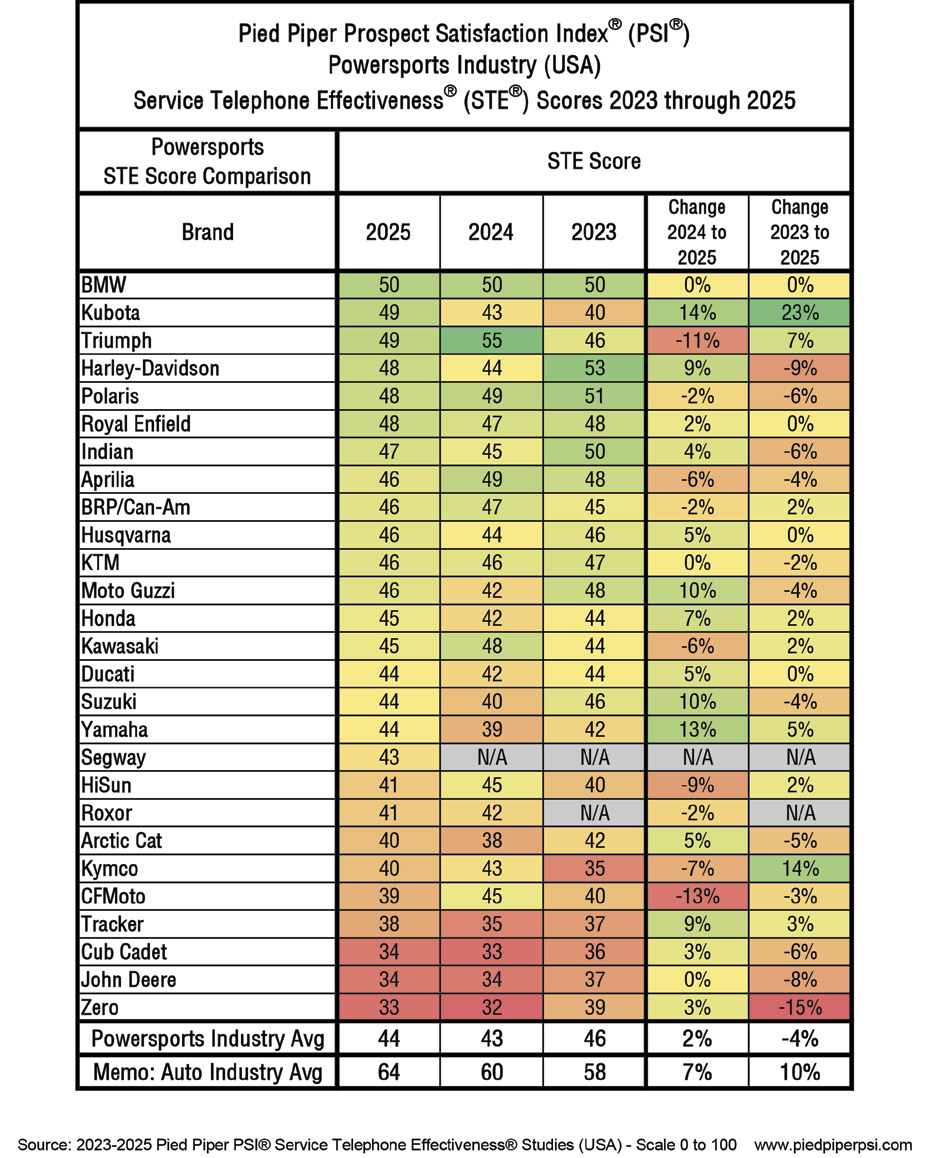

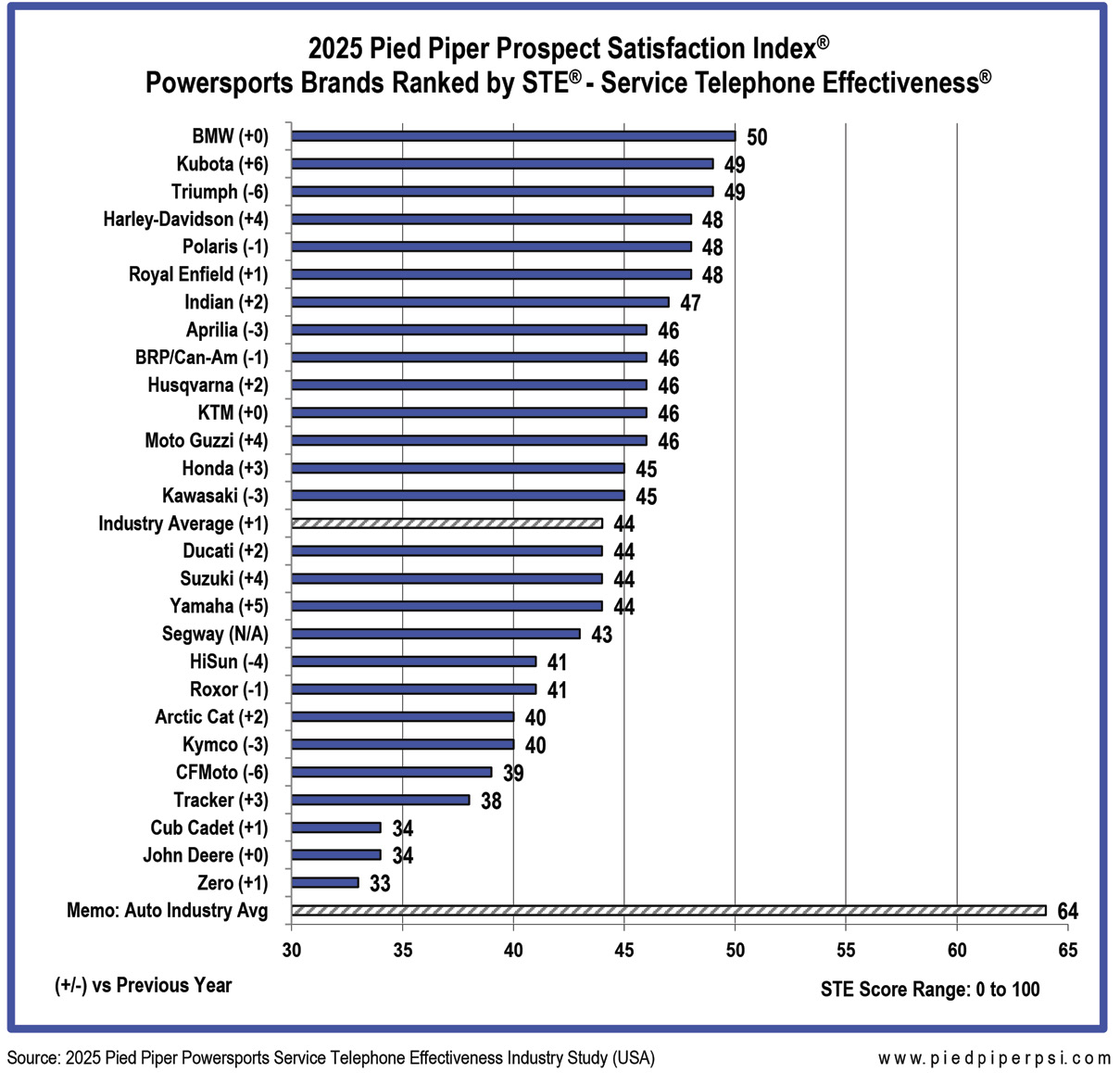

Effectiveness (STE) Powersports Industry Study on June 2, which measured the efficiency and quality of customer attempts to schedule service appointments by telephone, with BMW Motorrad dealerships ranking No. 1. Following BMW were Kubota, Triumph, Polaris Off-Road, and Harley-Davidson.

achieved in both 2023 and 2024. “BMW has consistently been ranked among the top three performing brands during the three years this annual study has been conducted,” says Cameron O’Hagan, Pied Piper’s vice president of metrics and analytics . “This year, they have achieved the top position due to that consistency.”

BMW Motorrad dealerships had the highest score on Pied Piper’s 2025 PSI Service Telephone Effectiveness (STE) Powersports Industry Study, which measured the efficiency and quality of customer attempts to schedule service appointments by telephone. Following BMW were Kubota, Triumph, Polaris Off-Road, and Harley-Davidson.

ATV/UTV

18 Behind-the-scenes look at Denago’s

China operations 20 Honda brings back the FourTrax 21 Dealership supports tornado survivors

Pied Piper submitted service calls to 1,531 powersports dealerships representing 27 brands, then evaluated the telephone interactions . Each brand’s overall STE score is a combined average of its dealer performances. Scores ranged from 0 to 100 and included over 30 differently weighted measurements tracking the best practices most likely to generate service revenue and customer loyalty.

The following are examples of behaviors that set BMW dealers apart from the industry average when customers call for service:

Pied Piper submitted service calls to 1,531 powersports dealerships representing 27 brands and evaluated the telephone interactions . Each brand’s overall STE score is a combined average of its dealer performances. Scores ranged from 0 to 100 and included

ACCELERATE

Higher rate of setting appointments: 65% of BMW service calls resulted in an appointment being set, compared to only 52% for the industry overall.

22 Young Powersports XL — more than a mega-store

BMW led the 2025 STE study with an average STE score of 50, the same score the company achieved in both 2023 and 2024. over 30 differentlyweighted measurements tracking the best practices most likely to generate service revenue and customer loyalty.

More likely to ask about other issues: BMW customers were asked if they had any other issues or needed any additional service 35% of the time on average, compared to only 22% of the time for the industry overall.

CONSISTENCY IN CHALLENGING CONDITIONS

MOTORCYCLE

Pied Piper released its PSI Service Telephone

BMW led the 2025 STE study with an average STE score of 50, the same score BMW

24 Honda brings back CRF Trail models 24 BMW: 50 stories from the last 50 years 25 Distillery moves into H-D HQ 26 Kawasaki expands dual-sport lineup

See BMW , Page 7