Making It Rain

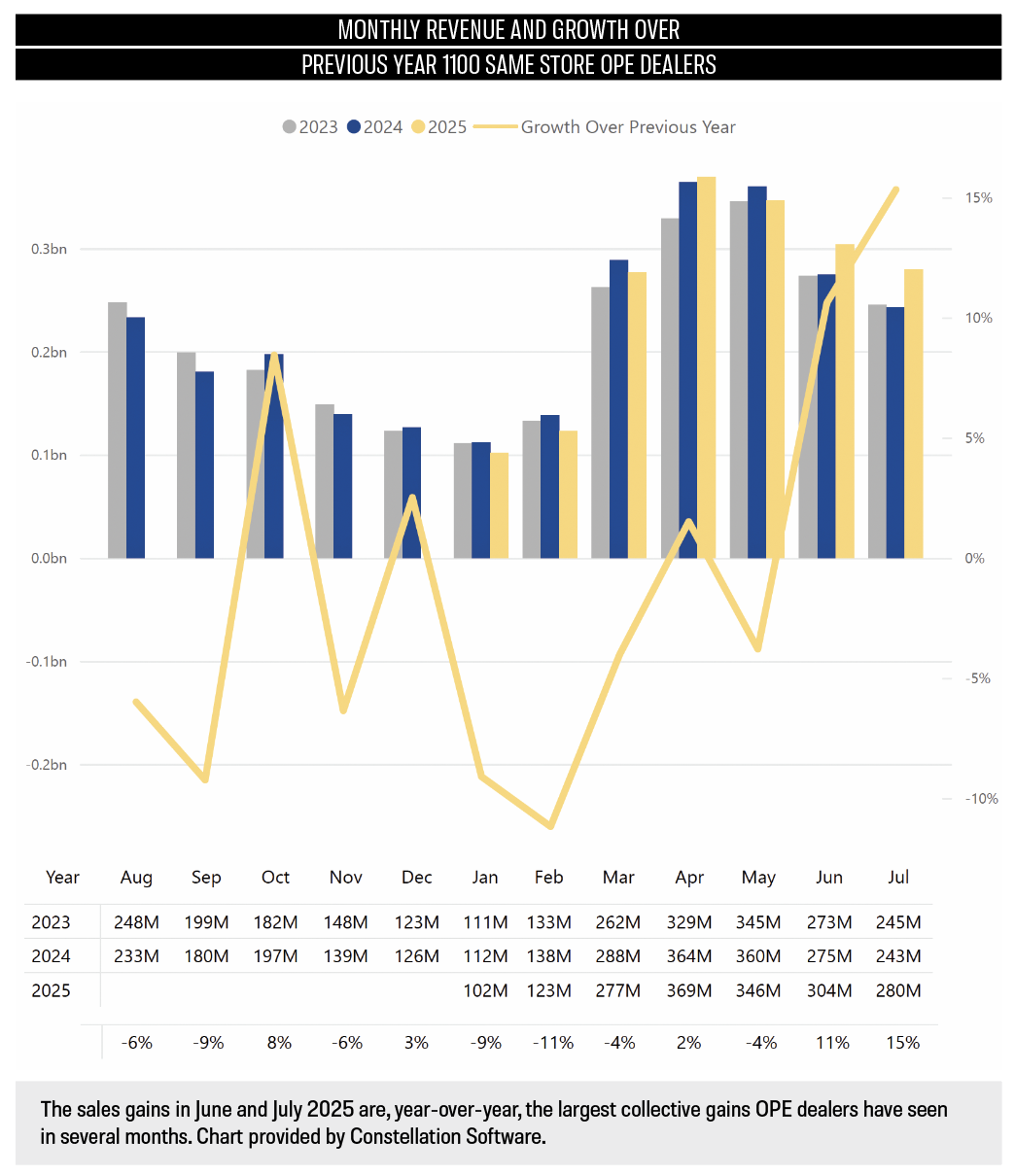

A year ago, we looked at July sales and saw a 6% drop from July 2023. Wholegoods sales were down 9% nationwide with OPE dealers in the Northeastern U.S. reporting declines of 18 percent.

Today, we see that mid-summer same-store sales are up, year over year. For both June and July 2025, OPE dealers showed significant gains in both parts and wholegoods sales, with overall revenue growth too.

Department Sales: July 2025 compared to July 2024

-

Wholegoods: +23%

-

Parts: +14%

-

Service: +5%

-

Total dealership: +20%

OPE dealers found success across the board in July, with dealers in every region of the country posting positive numbers in parts, service and wholegoods – all except the western region OPE dealers who struggle with subpar service numbers. Tractor dealers in the U.S., however, did not see the same gains. While U.S. tractor dealers made gains in June, monthly revenue for July compared to the same period in 2024 was off 2%.

Most parts of the nation dealt with above-average rainfall in June and July. Unfortunately, some regions suffered from catastrophic and deadly flooding.

Dealers in the South earned the strongest numbers, led by big gains in wholegoods sales, followed by Midwest dealers. OPE dealers in Canada struggled across the board, with negative reports in parts, service and wholegoods sales.

OPE+ Dealer Survey

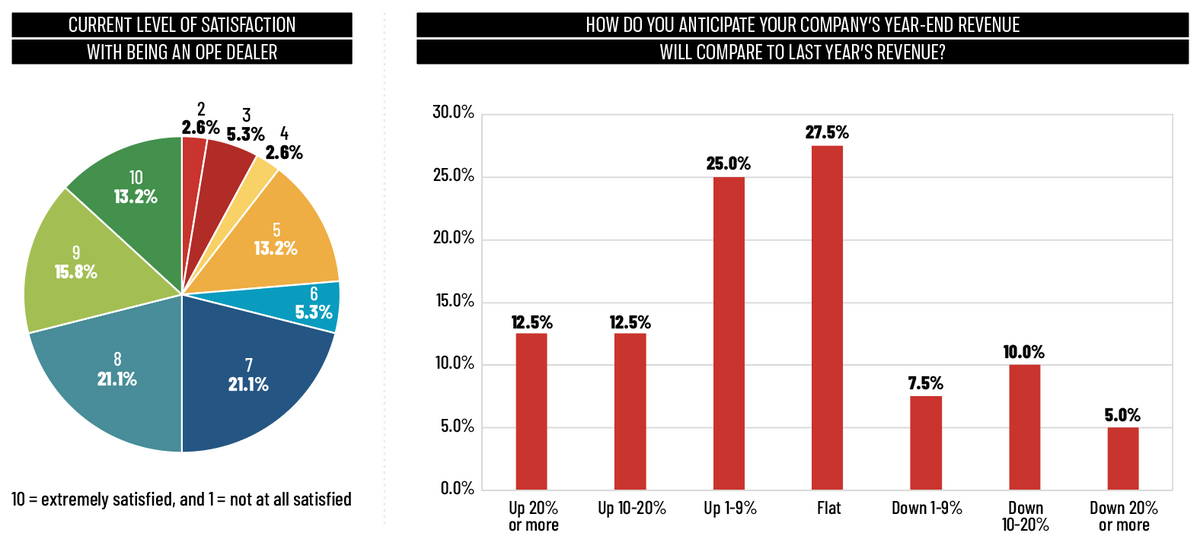

We wanted to compare sales data to in-dealership factors such as inventory, sales planning, sentiment and more. Here is our most recent survey data of OPE dealers across the U.S.

Dealership performance by business segment

General Business Conditions

-

Very Strong: 13%

-

Strong: 23%

-

Average: 39%

-

Subpar: 25%

New Unit Sales

-

Very Strong: 13%

-

Strong: 28%

-

Average: 32%

-

Subpar: 25%

-

Poor: 2%

Used Unit Sales

-

Very Strong: 11%

-

Strong: 14%

-

Average: 53%

-

Subpar: 20%

-

Poor: 2%

P&A

-

Very Strong: 14%

-

Strong: 37%

-

Average: 40%

-

Subpar: 9%

-

Poor: 0%

Service

-

Very Strong: 16%

-

Strong: 41%

-

Average: 32%

-

Subpar: 11%

-

Poor: 0%

F&I

-

Very Strong: 5%

-

Strong: 9%

-

Average: 68%

-

Subpar: 15%

-

Poor: 3%

Current level of satisfaction with being an OPE dealer

Strong sales mean satisfied dealers. More than 50% state strong satisfaction with current business. Very few – the lowest number we’ve seen in reporting over the last two years – say they are on the low-end of the satisfaction index.

Dealer comments

-

“The biggest issue is not knowing what the political issues are going to be ahead of time. Concerned about the buyer going into a shell.”

-

“The current political environment makes it very difficult to forecast. It seems as though policies and economy change almost daily. Just not much stability.”

-

“I feel manufacturers took advantage of tariffs to increase prices more than to absorb costs.”

-

“As a dealership actively acquiring locations, there doesn’t seem to be an end to the supply of opportunities to purchase other dealerships. Seems like a lot of exiting happening right now.”

-

“The increase in parts cost is my biggest concern.”

-

“OEMs and distributors seem to be playing by the Golden Rule: I have the gold and I make the rules. They say they want their dealers to be successful and make money while they are busy cutting dealer margins and kissing box store’s rear end.”

End credit

Same-store sales data is provided by Ideal Computer Systems. Drawing from more than 1,700 dealers on a nightly basis, this data warehouse is the largest, most accurate source for dealership and market year-over-year trending information in the industry.